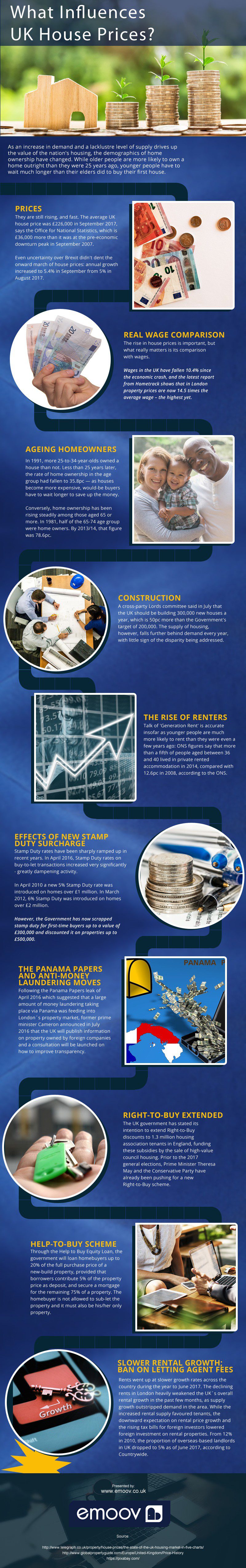

Do you have plans of investing in the property market but you are still waiting for the right moment where the price is favourable to you? Watching for prices to move will do well for your goal; however, it is not just the sole factor that must affect your decision because prices tend to move up and down. You should look at the factors that cause the price to change. More so, predicting the price for the next month or year to come would be easier if you are watching over these factors. What are these factors that you should look into? This infographic will help you make a decision to invest today or a week after.

1. Changes in the average wages in the country. There could be an increase in the wages allowing the potential homebuyers to afford the houses. However, if the price increase is higher than the change in the wages, you could have doubts about buying properties.

2. The age group of the homebuyers tends to get older as time goes by. In the early 1990s, homeowners have ages from 25-34. However, in the 2000s, homeowners’ ages increased up to 65-74 age groups. This means that people tend to buy houses as they get older primarily because they need more time to save a lot and be able to buy a property.

3. In line with that, because homeowners are buying at an older age, they tend to rent only. More and more are renting that’s because the millennial prefer freedom to move whenever their work demands. Official of National Statistics showed that younger people with ages from 36-40 rent a private accommodation. That’s why this is called the “Generation Rent”.

4. The government’s changes in policies, as well as support given to the housing market, play an important factor that influences price movements. However, the government’s actual number of houses being built falls shorter than its targeted values.

5. Another government intervention that created an impact on the housing market is the changes on stamp duty. When taxes are imposed, prices of the properties will significantly increase. However, the changes were basically segmentised such as properties amounting to one million or two million pounds. But, recently, the government has lifted the stamp duty for first-time buyers, which encourages everyone to get their house for the first time.

6. The government’s right-to-buy and help-to-buy programs that were extended to more than 1.3 million housing associations gave more accessibility to tenants in England. Equity loans that were provided to homebuyers allow them to have higher chances of getting their own house.

7. As you can see, there are many factors that you should look for before making an investment. Prices are volatile, wages are changing, customer preferences are changing, consumer attitude shift towards a flexible living, government policies are both favourable and unfavourable at times and your personal motivation for getting a house affect your decision criteria. Given the factors that affect the performance of the housing market, how are you going to make an investment in the property market?

Comments

Download this infographic.