Nov 13, 2025

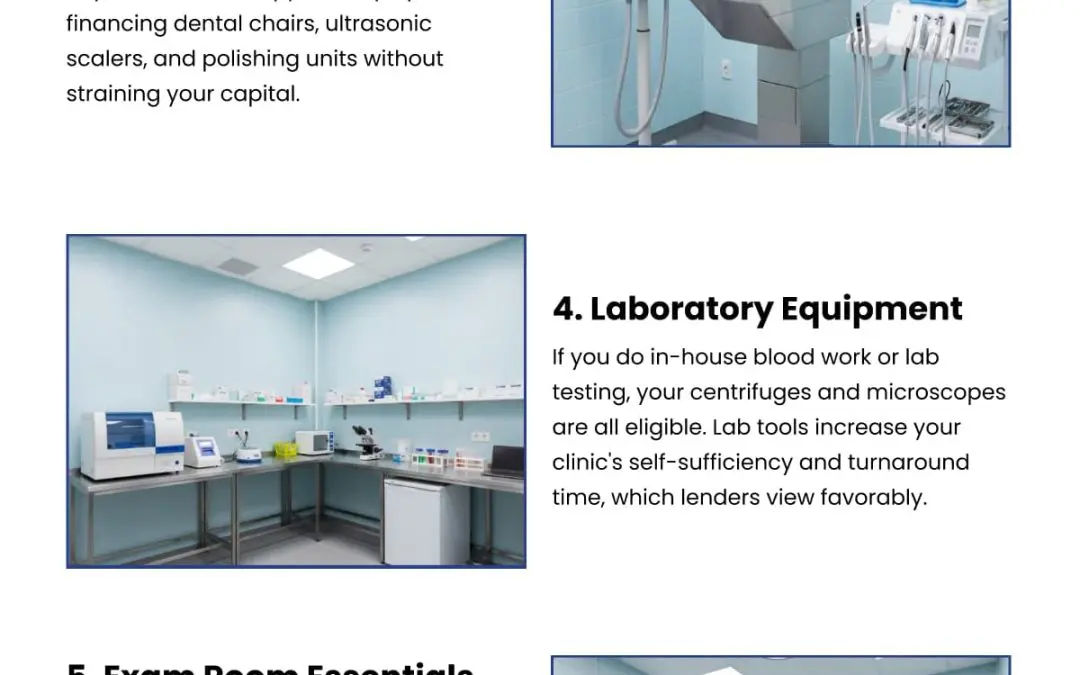

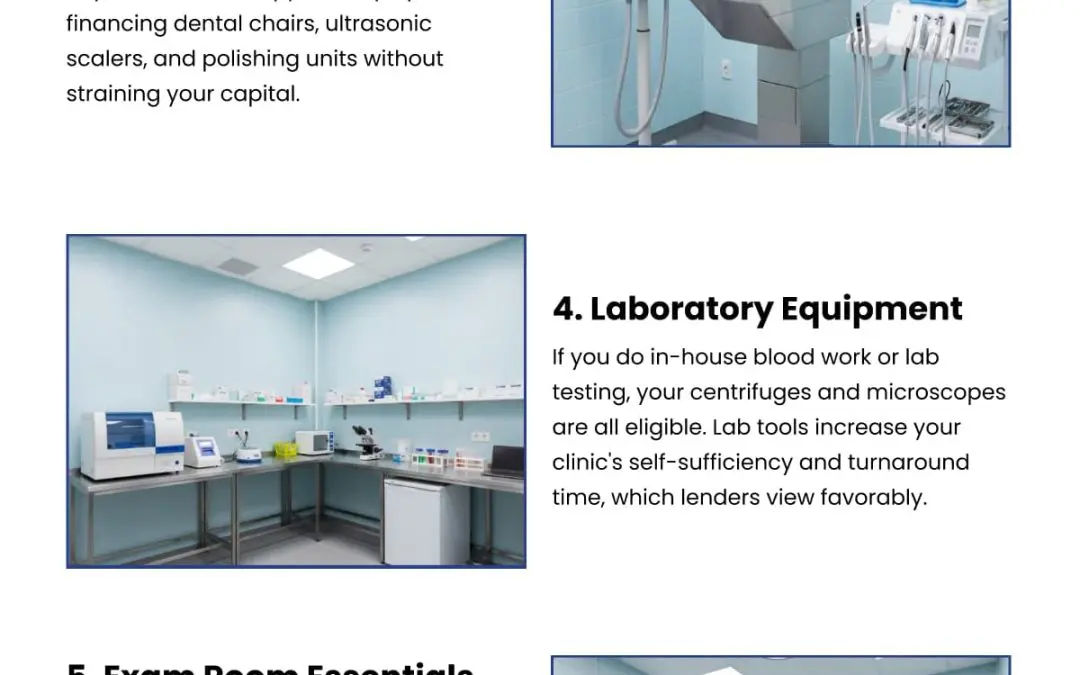

Veterinary-focused lenders are often willing to finance the essential tools and technology your clinic depends on, as long as the equipment is a tangible, revenue-generating asset with at least a year of usable life. High-value diagnostic machines, such as digital...

Nov 4, 2025

Selling a home in Pennsylvania without investing in major repairs is not only possible but often far more practical than many homeowners realize. Instead of pouring money into contractors, permits, and upgrades with no guarantee of a return, you can choose to sell...

Nov 4, 2025

Falling behind on your Charlotte property taxes triggers a chain reaction that becomes more serious the longer it goes unresolved. Once a payment is missed, interest and penalties begin piling up immediately, turning what may have started as a manageable balance into...

Oct 23, 2025

Selling long-held stock can come with a hefty tax bill, but a Deferred Sales Trust (DST) offers a way to defer those capital gains while maintaining flexibility and control. Instead of selling your stocks directly, you transfer them into a trust that sells on your...

Oct 21, 2025

The No Surprises Act (NSA) is a powerful tool for securing fair reimbursement, but its complexity often leads to misinterpretation—something insurers commonly exploit. Many providers unknowingly leave money on the table by assuming certain claims don’t qualify...

Oct 21, 2025

Liquidity planning is a critical component of a multi-generational wealth strategy, providing executives and high-net-worth families with the flexibility to navigate unexpected challenges without compromising long-term goals. By structuring assets to ensure cash is...

Post Infographics > Finance > Page 7