Nov 4, 2025

Falling behind on your Charlotte property taxes triggers a chain reaction that becomes more serious the longer it goes unresolved. Once a payment is missed, interest and penalties begin piling up immediately, turning what may have started as a manageable balance into...

Oct 21, 2025

The No Surprises Act (NSA) is a powerful tool for securing fair reimbursement, but its complexity often leads to misinterpretation—something insurers commonly exploit. Many providers unknowingly leave money on the table by assuming certain claims don’t qualify...

Sep 16, 2025

A merchant cash advance (MCA) is a flexible financing option that provides fast access to capital, sometimes as quickly as the same day, making it a valuable tool for businesses that need quick funding without the lengthy approval process of traditional loans. Its...

Aug 14, 2025

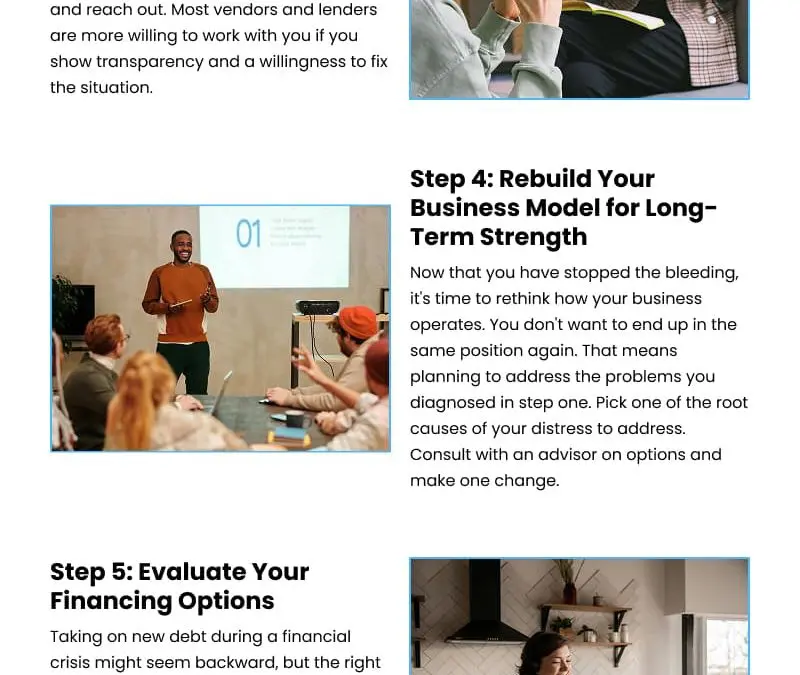

When a business hits a financial rough patch, it’s easy to feel overwhelmed, but challenges can also mark the start of a strategic rebuild. Recovery begins with an honest diagnosis, facing the reality of your situation, and identifying the true causes of...

Aug 5, 2025

Indexed Universal Life Insurance (IUL) is a powerful tool for building long-term financial security, but choosing the right provider is key. IULs aren’t available through banks or most financial advisors; they’re offered by life insurance companies...

Aug 5, 2025

Financial reporting is far more than a compliance task; it’s a strategic tool that drives growth, strengthens credibility, and keeps your business on track. Providing accurate, timely, and comprehensive data gives you a clear understanding of your...

Post Infographics > Finance > Page 2