Mar 20, 2025

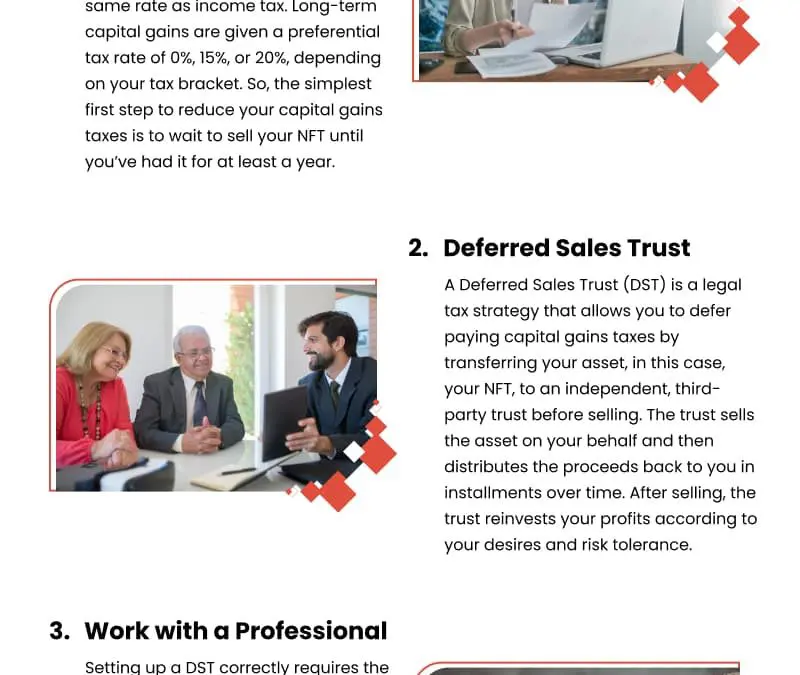

Minimizing capital gains taxes on cryptocurrency and NFTs requires smart tax planning. While you can’t completely avoid taxes on realized gains, you can use strategies to reduce and defer them. First, understand how short-term and long-term gains are taxed. If you...

Mar 20, 2025

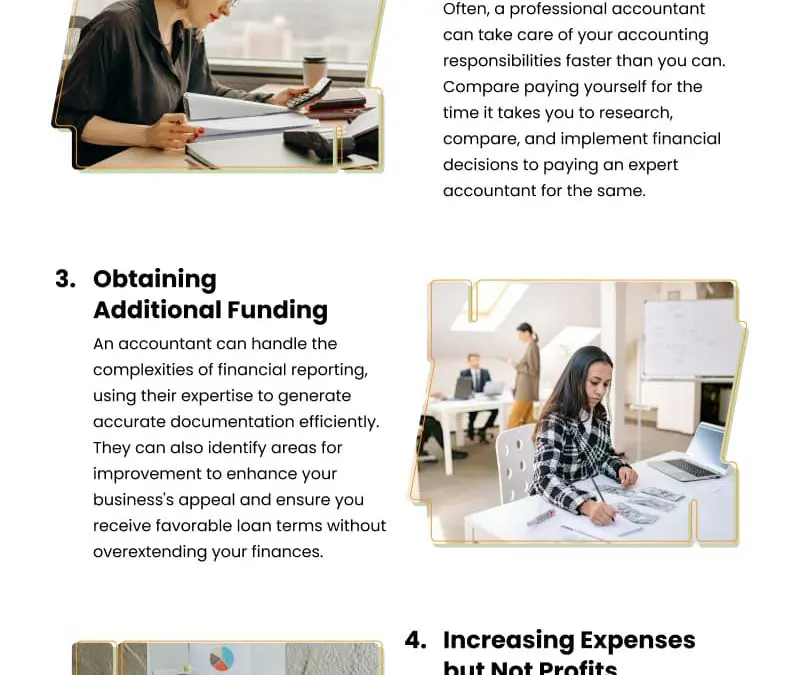

As a small business owner, you manage many tasks yourself, but at some point, handing off critical operations like accounting becomes essential. An accountant can streamline your finances and provide expert insights that go beyond basic bookkeeping. If tax season...

Mar 4, 2025

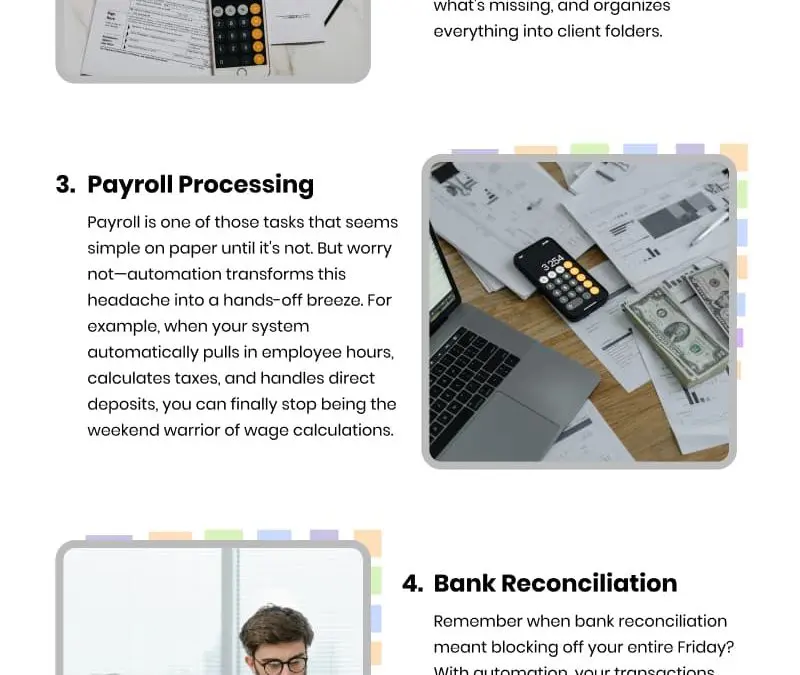

If you’re still manually grinding through accounting tasks, it’s time to embrace automation and free up valuable time. Many accountants stick to outdated processes because change feels risky, but automation streamlines workflows and reduces errors. Data entry and...

Feb 27, 2025

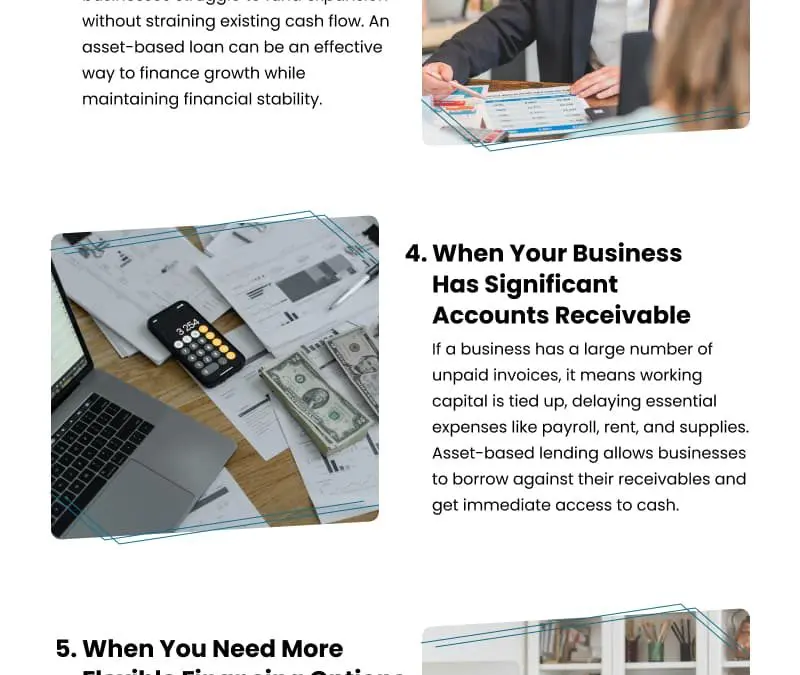

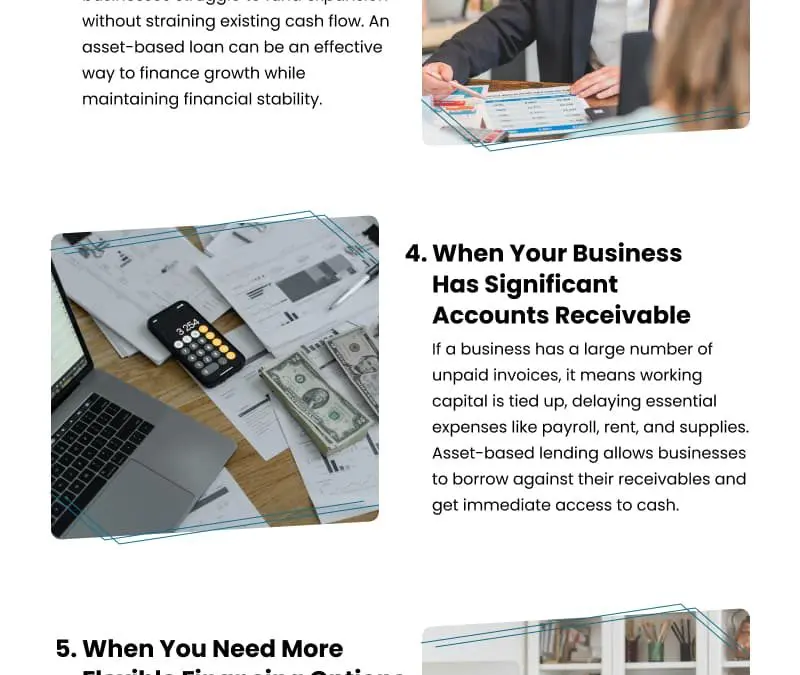

Asset-based loans (ABLs) are a valuable financing option for businesses facing cash flow challenges or seeking flexible funding solutions. They are ideal for companies with valuable assets like inventory, accounts receivable, or equipment but inconsistent cash flow,...

Feb 20, 2025

Aspiring accountants should prioritize software skills to stay competitive in an evolving industry. Excel remains essential, as not all businesses have fully adopted AI and automation. Familiarity with popular bookkeeping software like QuickBooks, Sage Intacct, and...

Feb 20, 2025

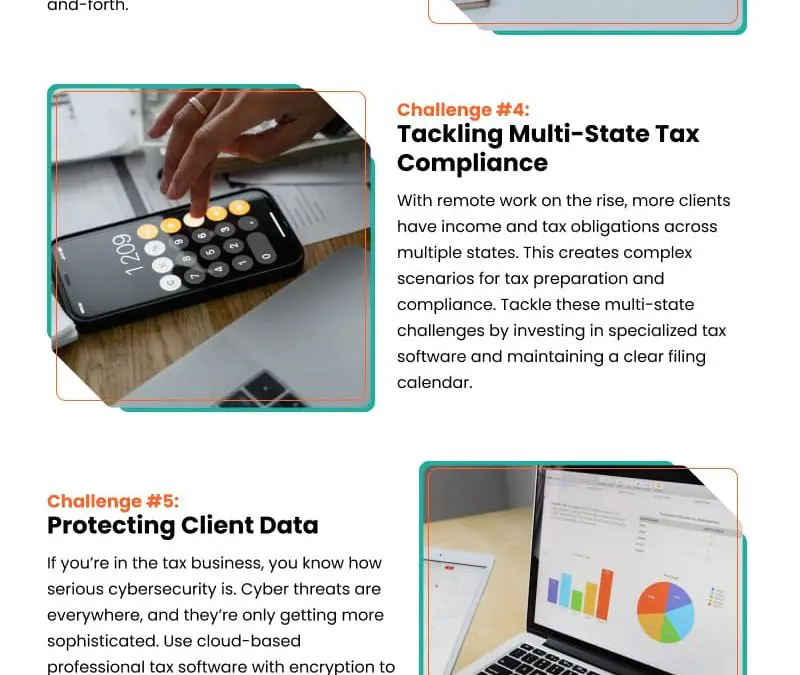

Tax season is becoming increasingly complex, with evolving regulations, tighter deadlines, and growing client demands. Staying updated on tax law changes is essential, and using regularly updated tax software can help preparers navigate shifting policies. The rise of...

Post Infographics > Finance