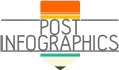

The tax industry is embracing AI and automation for significant benefits. Here are some functions AI can perform to enhance your business.

- AI automates data entry, reducing errors and freeing up time. It also categorizes taxable and non-taxable transactions, improving over time through machine learning.

- AI can analyze large datasets, identify patterns, and improve its predictive capabilities. This helps detect fraud, tax evasion, and calculate future tax liabilities based on financial behavior and tax code changes.

- AI streamlines the process of identifying deductions and tax credits by quickly pinpointing potential deductions and credits based on responses in professional tax software. However, it’s important to note that AI can’t verify the validity of deductions; it can only guide tax preparers to the right documentation.

- For client management, AI simplifies scheduling by enabling clients to set, cancel, and reschedule appointments.

- It also automatically generates document tags, categorizing uploaded documents for easy retrieval, thereby enhancing the efficiency of your client database software.

By leveraging these AI capabilities, the tax industry can improve accuracy, efficiency, and client satisfaction, paving the way for more effective tax preparation and management.

source: https://ultimatetax.com/blog/how-artificial-intelligence-affects-the-tax-industry/

Comments

Download this infographic.