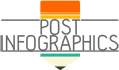

Navigating taxes after a divorce can be overwhelming, but taking proactive steps can help you understand and manage your new tax situation. First, determine your filing status based on your divorce’s finalization date, as this affects your tax options. If you are not filing jointly with your ex-spouse, consider whether you qualify to file as head of household. This status may offer financial advantages, especially if you have child custody. Next, update your W-4 information with your employer to reflect your changed marital status and adjust your withholdings accordingly. Remember to account for alimony payments, typically deductible for the payer and taxable for the recipient. Follow the terms outlined in your divorce decree regarding alimony and child support. Finally, clarify who can claim children as dependents, affecting your filing status and eligibility for tax credits. Consulting with a family law attorney or tax expert can provide invaluable guidance in navigating your post-divorce tax situation, ensuring you maximize available credits and deductions while minimizing tax liabilities.

Navigating taxes after a divorce can be overwhelming, but taking proactive steps can help you understand and manage your new tax situation. First, determine your filing status based on your divorce’s finalization date, as this affects your tax options. If you are not filing jointly with your ex-spouse, consider whether you qualify to file as head of household. This status may offer financial advantages, especially if you have child custody. Next, update your W-4 information with your employer to reflect your changed marital status and adjust your withholdings accordingly. Remember to account for alimony payments, typically deductible for the payer and taxable for the recipient. Follow the terms outlined in your divorce decree regarding alimony and child support. Finally, clarify who can claim children as dependents, affecting your filing status and eligibility for tax credits. Consulting with a family law attorney or tax expert can provide invaluable guidance in navigating your post-divorce tax situation, ensuring you maximize available credits and deductions while minimizing tax liabilities.

source: https://divorceattorneyut.com/5-steps-for-filing-your-taxes-after-divorce/

Comments

Download this infographic.