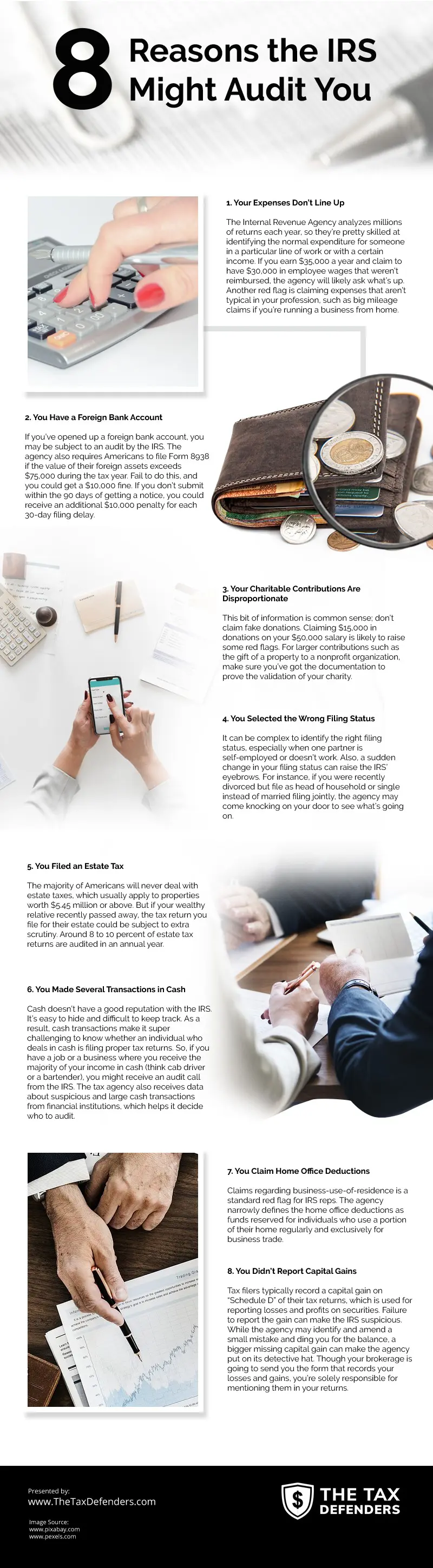

When you have no other income and then you were laid off just recently, being audited by the IRS is the last thing you would want to hear about. If you are not being careful of how you must file your taxes, an audit will be at your doorsteps. Even if you are diligently paying your taxes, there will be situations when you would be under the audit of IRS. If any of the following scenarios happen, an unexpected IRS audit might happen.

1. Your income and expenses don’t match. Your IRS auditors are experts in their fields and they are encountering frauds almost on a daily basis. If you try to fake your expenses so that your taxable income would be low, they will find out easily. They know the nature of your work, the income that you have and your lifestyle. A claim for fuel expenses would be ineffective if your business operations are in your home.

2. Did you open a foreign bank account recently? If you did, then you must have filed the appropriate form especially if your assets reached $75,000 or more. If you did not file for it, expect a $10,000 fine on your next cycle. In addition, you will receive 90 days grace period to settle it. Failure to do so will mean an additional $10,000 penalty. Sounds painful right?

3. Even if you are truly donating to charitable institutions, you might still be audited. How? They will look into the amount that you donate. If they saw that you are donating more than what you are capable of, that will raise the red flag in the IRS. However, if you really donated a large amount to a charity, ensure that you have proper documentation to support your claim.

4. Wrong filing status can also cause you to be audited by the IRS. What does it mean? If you change your status from self-employed to unemployed, your partner’s status to self-employed to head of the family or simply from being single to married, expect IRS people knocking at your doors. Sounds stringent but these people just do their job.

5. Estate taxes are a little complex to deal with. This tax applies to property with a market value of $5.45 million or above. Expect that there will be around 8 to 10% of tax returns on the properties. For properties of a dead relative that were passed to your care, the agency will undergo a stricter scrutiny of the properties true market value.

6. Cash transactions raise a red flag in the IRS. Paying on a cash basis poses a challenge to be detected by the IRS people. If you want to hide your true wealth, paying in cash may get you away from being taxed heavily. However, it will not make you escape the IRS audit. They will know if you are paying cash more often and how much do you usually spend.

7. Home office deductions and not reporting capital gains are also reasons why you could be audited. Capital gains are reported to IRS through “Schedule D”. This is where your profits and losses can be seen. If you intentionally left out a capital gain, you will earn an audit from IRS.

source: https://www.thetaxdefenders.com/8-reasons-the-irs-might-audit-you/

Comments

Download this infographic.