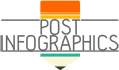

While avoiding capital gains tax when selling farmland completely is impossible, several strategies can help reduce, delay, or minimize the tax liability. One method is through property transfer to heirs, which doesn’t eliminate capital gains taxes but steps up the cost-basis to the current fair market value at the time of death. Another option is donating farmland to charity before selling it, as this allows you to avoid taxes on the donated portion and deduct the donation from your taxable income. However, there is a limit to the deductible amount, with excess amounts rolled over to future years.

The 1031 Exchange is a popular strategy for deferring taxes on real estate, including farmland. This allows you to delay paying capital gains taxes by reinvesting the sale proceeds into a “like-kind” property. Another effective approach is investing in Delaware Statutory Trusts (DSTs), where multiple investors hold fractional interests in the trust’s real estate holdings. DSTs have recently become eligible for 1031 exchanges, enabling you to diversify your risk by reinvesting proceeds into a DST.

Lastly, a Deferred Sales Trust (DST) offers a reliable way to defer capital gains taxes. You receive a promissory note in return by selling your property to the trust, which then sells it to a buyer and retains the proceeds. This approach allows you to defer capital gains taxes while potentially benefiting from ongoing income.

source: https://capitalgainstaxsolutions.com/can-you-really-avoid-capital-gains-tax-on-farmland-sales/

Comments

Download this infographic.