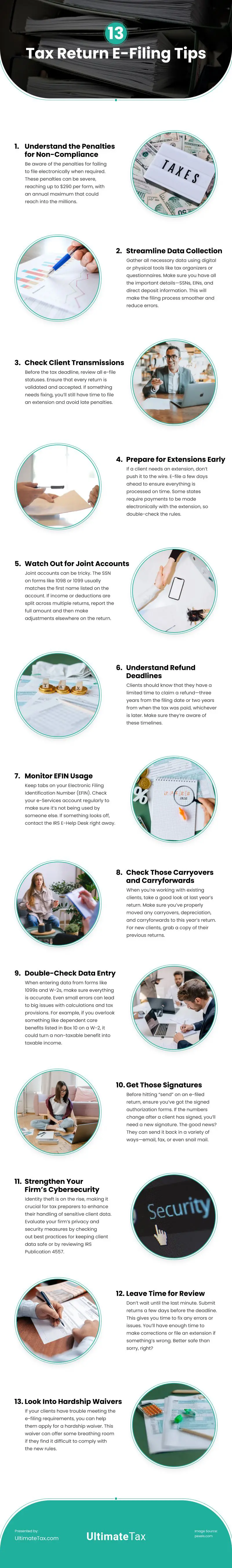

E-filing offers the speed and convenience clients expect, but compliance with IRS standards is crucial. To avoid penalties, it’s essential to understand the consequences of non-compliance, such as fines of up to $290 per form. Streamlining data collection with organized tools minimizes errors, and regularly checking e-file statuses ensures that any issues are addressed before deadlines, giving you time to file extensions if needed.

For smooth filing, be cautious with joint accounts, as tax form SSNs should match the first listed account holder. Keep clients informed about refund deadlines—either three years from the filing date or two years from payment. Monitor your EFIN regularly to ensure it’s not misused, and always verify carryovers and data entries, like dependent care benefits, to avoid unintentional tax consequences.

Securing signed authorization forms before filing and updating signatures if changes occur is vital. Bolstering cybersecurity, per IRS guidelines, protects sensitive client data. Reviewing returns in advance ensures accuracy, and hardship waivers can offer relief if clients struggle with e-filing rules. Emphasizing these practices can make your clients’ e-filing process seamless and compliant.

source: https://ultimatetax.com/blog/best-practices-for-e-filing-your-clients-tax-returns/

Comments

Download this infographic.