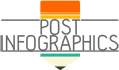

Managing payroll can be overwhelming for small business owners, taking time away from more creative and strategic aspects of running a business. Follow these tips to handle payroll better and avoid costly mistakes. First, meticulously schedule employee payments and tax obligations to ensure timely payment and avoid IRS penalties. Use an online calendar or custom schedule to stay organized and on track. Next, invest in seamless payroll software to save time and reduce costs by automating tasks like tracking employee hours, vacation time, and tax calculations. Consider automating payments using reliable payroll software or providers that offer audit support to avoid penalties for late tax submissions. Understanding payroll laws is crucial. The Fair Labor Standards Act (FLSA) and other regulations set wages, pay equality, and documentation standards. Seek help from professionals like CPAs, tax advisors, business attorneys, or customer service representatives from your accounting software if needed. Properly classifying employees is crucial, as independent contractors and full-time employees have different payroll and tax implications. Use the IRS classification guide to integrate this information into your payroll system correctly. Maintaining thorough records is a legal requirement to ensure compliance with tax and payroll laws. This will simplify finding necessary information and ensure legal compliance. Double-check your data entries to prevent costly errors. Mistakes in data entry can lead to financial losses and employee dissatisfaction. To enhance efficiency and accuracy, consider hiring a dedicated payroll manager with HR, finance, or accounting skills. Avoid using tax funds for other business expenses. Set up a separate bank account for tax funds to keep this money separate. Lastly, consider outsourcing payroll to professional accounting services. They can handle payroll, minimize IRS risks, and provide additional financial services to improve cash flow, secure funding, and support business growth. Streamlining your payroll tasks ensures accuracy and frees up time to focus on growing your business, leading to a healthier and more successful enterprise.

source: https://www.trustbgw.com/blog/payroll-management-tips-for-business-owners

Comments

Download this infographic.