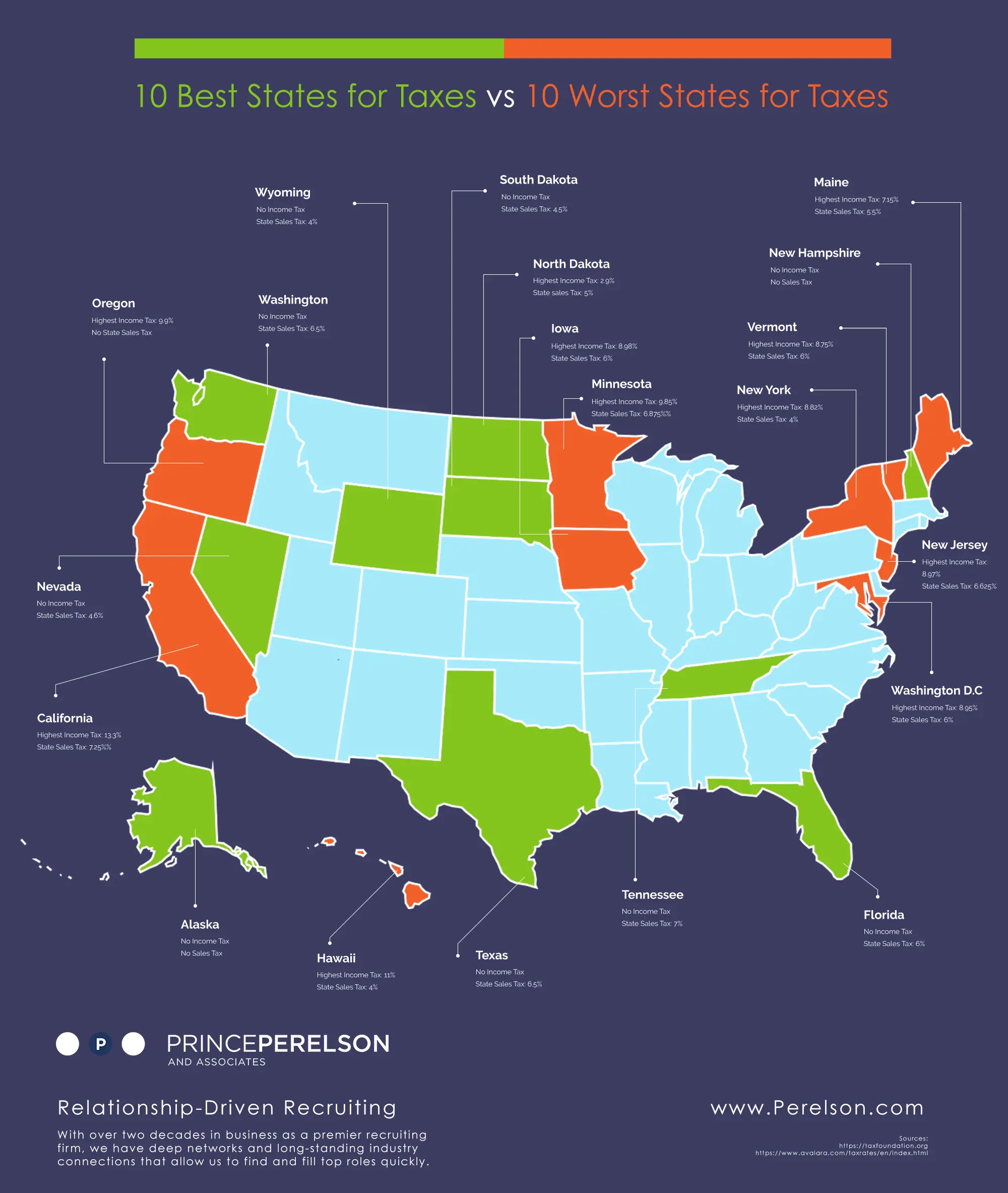

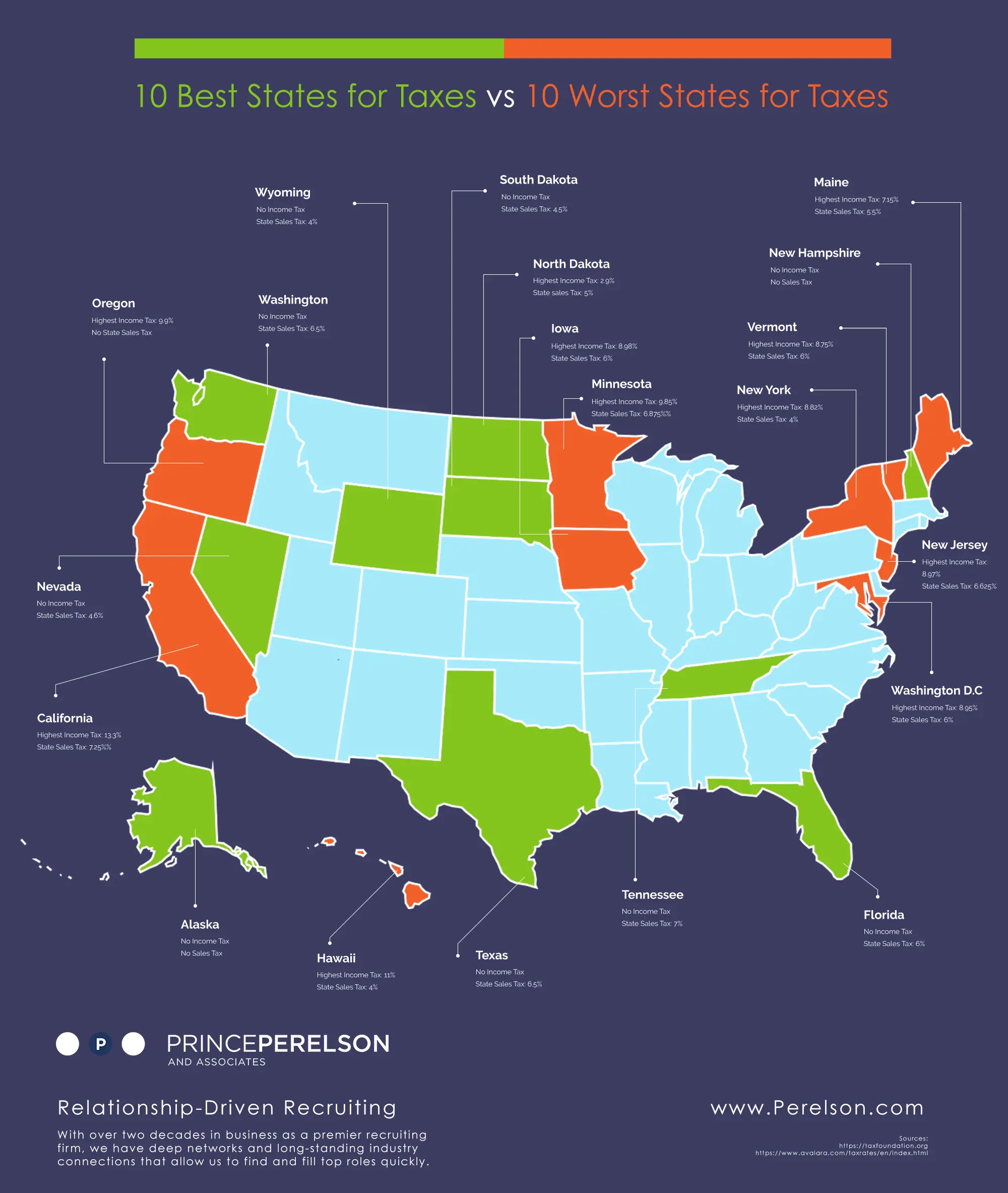

As the tax season is almost in full swing and the last day to file such taxes just around the corner, many of us are left wondering exactly how our taxes compare to the rest of Americans all over the country. Read on to know the list of the top 10 best and worst states in the US when it comes to taxation burdens of sales and income tax.

Best States for Taxes

(Tie below for #1)

9. North Dakota

Highest Income Tax: 2.9%

State Sales Tax: 5%

8. Tennessee

No Income Tax

State Sales Tax: 7%

7. Washington

No Income Tax

State Sales Tax: 6.5%

6. Texas

No Income Tax

State Sales Tax: 6.25%

5. Florida

No Income Tax

State Sales Tax: 6%

4. Nevada

No Income Tax

State Sales Tax: 4.6%

3. South Dakota

No Income Tax

State Sales Tax: 4.5%

2. Wyoming

No Income Tax

State Sales Tax: 4%

1. (Tie) Alaska & New Hampshire

No Income Tax

No Sales Tax

Gauging from the above statistics, it appears that the best state to be at is New Hampshire and Alaska. If you reside in any of these 10 states mentioned, you are lucky. Most of these states do not charge income tax, with the highest charging only roughly 3% which is in North Dakota. Sales tax is at its highest at 7% which is in Tennessee. If you live in these states, you can rest assured that basic commodities cost less than anywhere else in the country. This means, you get to take home your entire pay without any deductions if you happen to reside in these states as Florida, Texas, Washington, Tennessee, Nevada, South Dakota, Wyoming, Alaska, and North Hampshire.

Worst State For Taxes

On the contrary, the worst states to be at in terms of taxes are the following:

10. Oregon

Highest Income Tax: 9.9%

No State Sales Tax

9. Maine

Highest Income Tax: 7.15%

State Sales Tax: 5.5%

8. New York

Highest Income Tax: 8.82%

State Sales Tax: 4%

7. Vermont

Highest Income Tax: 8.75%

Sales Tax: 6%

6. Washington D.C.

Highest Income Tax: 8.95%

State Sales Tax: 6%

5. Iowa

Highest Income Tax: 8.98%

State Sales Tax: 6%

4. New Jersey

Highest Income Tax: 8.97%

State Sales Tax: 6.625%

3. Hawaii

Highest Income Tax: 11%

State Sales Tax: 4%

2. Minnesota

Highest Income Tax: 9.85%

State Sales Tax: 6.875%

1. California

Highest Income Tax: 13.3%

State Sales Tax: 7.25%

As per the figures above, the highest income tax is in California which is pegged at 13.3%; Hawaii comes next at 11%, Oregon at 9.9% and lastly, Minnesota at 9.85%. Sales taxes are its highest at California at 7.25%, Minnesota at 6.875% and New Jersey at 6.625%. It is very easy to understand why the cost of living in these places is just too high!

Major Tax Absence

It can be gleaned from the data above that the common denominator among several of these states is that there are many of them that do without one or more of these major taxes: income tax, sales tax, or the corporate income tax. Nevada, South Dakota, and Wyoming do not impose any individual or corporate income tax, Alaska does not have any sales or income tax, Florida has zero income tax too, and states such as Oregon, Montana, and New Hampshire does not charge any sales taxes.

High Taxes Have A Tendency To Weaken Businesses

A careful perusal of the 10 worst tax performing states, you will notice that most of them impose income tax with progressing rates, this transfers the burden to the working class who are contributing more to our economy, working hard, but still unable to get out of the rat race.

Bottom line is that taxation does matter. Take a closer look at the state and national data. We will close this by sharing with you a map of the report. Orange is the worst states and Green is the best ones.

Did your state make it to the list?

source: https://perelson.com/10-best-states-for-taxes-and-the-10-worst/

Comments

Download this infographic.